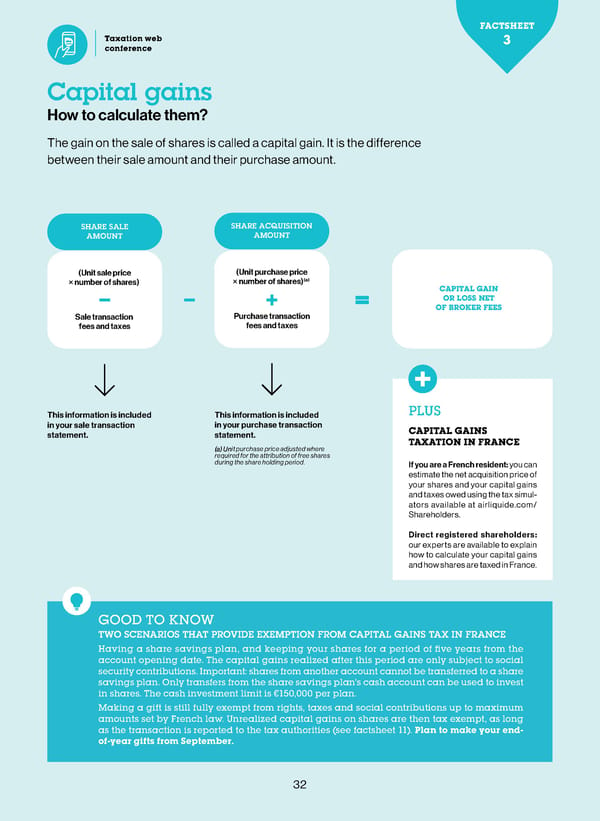

FACTSHEET FACTSHEET Taxation web 3 4 conference Capital gains Dividends How to calculate them? When and how do I receive them? The gain on the sale of shares is called a capital gain. It is the difference The dividend is the portion of the Group’s net profit that is distributed to shareholders. between their sale amount and their purchase amount. At Air Liquide, this portion represents about 50%; a sign of the Group’s commitment to sharing the fruits of its growth with you. SHARE SALE SHARE ACQUISITION Dividend payment AMOUNT AMOUNT The dividend will be paid out on May 30, 2018. Your bank account will be credited in the following days, depending on the processing PLUS time needed by your financial institution. (Unit sale price (Unit purchase price Direct registered shareholders: if you have changed your bank details, please send AN ADDITIONAL × number of shares) × number of shares)(a) us your new Bank Identification Statement accompanied by an identity document. 10% IN DIVIDENDS CAPITAL GAIN OR LOSS NET If you hold your registered shares for OF BROKER FEES more than two full calendar years, the Sale transaction Purchase transaction You don’t have loyalty bonus gives you the right to a fees and taxes fees and taxes (a) to do anything 10% increase in the dividend . (a) In accordance with Air Liquide’s articles of If you hold direct registered shares, association. the dividend, net of withholding taxes, is distributed by Air Liquide directly into your bank account. If you hold intermediary registered shares or bearer shares, Air Liquide distributes the gross dividend to your financial institution, which will then This information is included This information is included PLUS credit your account with the net dividend. in your sale transaction in your purchase transaction CAPITAL GAINS statement. statement. TAXATION IN FRANCE (a) Unit purchase price adjusted where 2018 dividend FOCUS ON required for the attribution of free shares during the share holding period. If you are a French resident: you can calendar DIVIDEND PAID IN 2018 estimate the net acquisition price of your shares and your capital gains May 25 May 28 May 30 (b) and taxes owed using the tax simul- €2.65 per share representing 53% ators available at airliquide.com/ Last execution day for buy Ex-dividend date. Dividend payment of net profit (Group share) Shareholders. orders for shares acquired The opening price on date. in this way to be eligible for this day is reduced by the (b) Amount proposed for the 2017 fiscal year at the Annual General Meeting on May 16, 2018. Direct registered shareholders: the 2017 dividend. amount of the dividend. our experts are available to explain how to calculate your capital gains and how shares are taxed in France. GOOD TO KNOW GOOD TO KNOW TAXATION OF DIVIDEND IN FRANCE FOR THOSE RESIDING OUTSIDE FRANCE FOR TAX PURPOSES TWO SCENARIOS THAT PROVIDE EXEMPTION FROM CAPITAL GAINS TAX IN FRANCE A statutory rate equal to at least 30% is withheld upon dividend payment by your account manager (Shareholder Services for direct registered Air Liquide shares, your financial institution for Having a share savings plan, and keeping your shares for a period of five years from the (c) intermediary registered or bearer Air Liquide shares). However, in most cases, a tax agreement is account opening date. The capital gains realized after this period are only subject to social signed between France and your country of residence. The main aim of this agreement is to set a security contributions. Important: shares from another account cannot be transferred to a share flat tax rate which is withheld from your dividends. To benefit from this rate, you must send Form savings plan. Only transfers from the share savings plan’s cash account can be used to invest (d) 5,000 (corresponding to the request to apply the rate adopted in the agreement), completed in shares. The cash investment limit is €150,000 per plan. and signed by the tax authorities of your place of residence, to your account manager by mid- Making a gift is still fully exempt from rights, taxes and social contributions up to maximum April. This Cerfa form can be downloaded from impots.gouv.fr. It must be resent to your account amounts set by French law. Unrealized capital gains on shares are then tax exempt, as long manager each year, otherwise the statutory rate will be applied upon payment of the dividend. as the transaction is reported to the tax authorities (see factsheet 11). Plan to make your end- (c)Tax agreement: a treaty between two countries aimed at avoiding the double-taxation of non-residents of-year gifts from September. (d) The Cerfa 5 000 is also known as Cerfa n°12816*01-02 32 33

2018 Shareholder's Guide Page 32 Page 34

2018 Shareholder's Guide Page 32 Page 34