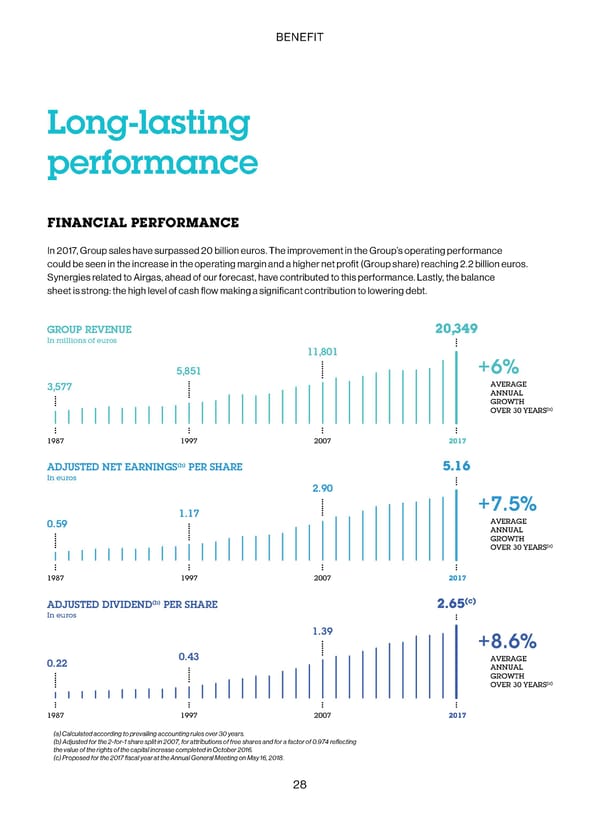

€739.31 +10.52% per ‡ear over €224.52 20 years +8.42% per ‡ear over €158.16 10 years +9.60% per ‡ear over BENEFIT Performance BENEFIT 5 years of your shares GROUP REVENUE 20,349 In millions of euros A REWARDING COMMITMENT 11,801 +6% FOR €100 INVESTED IN 1997 FOR €100 INVESTED IN 2007 FOR €100 INVESTED IN 2012 5,851 Value of portfolio at December 31, 2017 and average annual growth, before taxes. Air Liquide has always been driven by the will to involve its shareholders in its success. The Company’s share price has 3,577 AVERAGE Note: the referential ubscription ights relating to the capital increase undertaen in eptember 201 are recognied as having been sold, then reinvested in shares. Long-lasting ANNUAL been growing steadily and has outperformed the CAC 40 over a 10-year period and more. Moreover, the dividend, the GROWTH attributions of free shares and the payment of loyalty bonuses also contribute to the share’s return over the long term. (a) performance OVER 30 YEARS Long-term stock market performance 1987 1997 2007 2017 Growth as at 12/31/2017 (b) ADJUSTED NET EARNINGS PER SHARE 5.16 OVER In euros VALUE VALUE FINANCIAL PERFORMANCE 2.90 €140 €739.31 5 YEARS €140 +7.5% +10.52% OVER Air Liquide +37.30% In 2017, Group sales have surpassed 20 billion euros. The improvement in the Group’s operating performance per ‡ear over €224.52 1.17 10 YEARS €0 ‚€ƒ.„1… AVERAGE €120 20 years +8.42% €120 could be seen in the increase in the operating margin and a higher net profit (Group share) reaching 2.2 billion euros. 0.59 Air Liquide +66.10% Share at €76.51 ANNUAL OVER per ‡ear over €158.16 Synergies related to Airgas, ahead of our forecast, have contributed to this performance. Lastly, the balance 10 years GROWTH €0 Š ƒ.37… +9.60% (a) €100 €100 sheet is strong: the high level of cash flow making a significant contribution to lowering debt. OVER 30 YEARS 20 YEARS Share at €63.25 per ‡ear over 5 years Air Liquide +296.69% 1987 1997 2007 2017 €80 €0 ‚77.1ƒ… €80 GROUP REVENUE 20,349 Share at €26.48 In millions of euros (b) (c) ADJUSTED DIVIDEND PER SHARE 11,801 2.65 €60 €60 In euros +6% FOR €100 INVESTED IN 1997 FOR €100 INVESTED IN 2007 FOR €100 INVESTED IN 2012 5,851 1.39 Value of portfolio at December 31, 2017 and average annual growth, before taxes. AVERAGE €40 €40 3,577 +8.6% Note: the referential ubscription ights relating to the capital increase undertaen in eptember 201 are recognied as having been sold, then reinvested in shares. 0.43 ANNUAL Share at € 105.05 AVERAGE 0.22 GROWTH 2017 performance† ANNUAL (a) €20 €20 OVER 30 YEARS Air Liquide + 9.38% GROWTH (a) €0 ‚ „.2… OVER 30 YEARS 1987 1997 2007 2017 €0 €0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1987 1997 2007 2017 Growth as at 12/31/2017 (b) ADJUSTED NET EARNINGS PER SHARE 5.16 hare price ad‹usted to tae into account the stoc split in 2007, the free share attributions, and the capital increase OVER (a) Calculated according to prevailing accounting rules over 3 ears. ir ˆi‰uide In euros VALUE VALUE () dusted or the 2 or 1 share split in 27 or attriutions o ree shares and or a actor o .€74 reflecting in 201 lined to the ac‰uisition of irgas. hare price as at 12Œ31 of the ‡ear concerned. Note: past performances of ir ˆi‰uide’s share are not a guarantee of future results. €0Šindexed the value o the rights o the capital increase coƒpleted in „ctoer 216. 2.90 €140 OVER 5 YEARS €140 (c) …roposed or the 217 fiscal ear at the nnual ‡eneral ˆeeting on ˆa 16 218. +7.5% 10 YEARS Air Liquide +37.30% 1.17 €120 €0 ‚€ƒ.„1… €120 0.59 AVERAGE A steadily expanding portfolio Share at €76.51 ANNUAL Air Liquide +66.10% A shareholder who invested €100 in Air Liquide shares in registered form in 1997, reinvested his dividends GROWTH OVER €0 Š ƒ.37… (a) in shares and benefited from the free share attributions, both eligible for the loyalty bonus, would own a portfolio OVER 30 YEARS €100 20 YEARS Share at €63.25 €100 amounting to €739.31 at December 31, 2017. Air Liquide +296.69% 1987 1997 2007 2017 €80 €0 ‚77.1ƒ… €80 Share at €26.48 (b) (c) €739.31 ADJUSTED DIVIDEND PER SHARE 2.65 €60 €60 In euros +10.52% 1.39 per ‡ear over €224.52 €40 20 years +8.42% €40 +8.6% per ‡ear over €158.16 10 years Share at € 105.05 0.43 AVERAGE +9.60% 0.22 per ‡ear over ANNUAL €20 2017 performance† €20 5 years GROWTH Air Liquide + 9.38% (a) €0 ‚ „.2… OVER 30 YEARS €0 €0 GROUP REVENUE 20,349 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 In millions of euros 1987 1997 2007 2017 11,801 FOR €100 INVESTED IN 1997 FOR €100 INVESTED IN 2007 FOR €100 INVESTED IN 2012 (a) Calculated according to prevailing accounting rules over 3 ears. hare price ad‹usted to tae into account the stoc split in 2007, the free share attributions, and the capital increase ir ˆi‰uide () dusted or the 2 or 1 share split in 27 or attriutions o ree shares and or a actor o .€74 reflecting in 201 lined to the ac‰uisition of irgas. hare price as at 12Œ31 of the ‡ear concerned. 5,851 +6% Note: past performances of ir ˆi‰uide’s share are not a guarantee of future results. €0Šindexed the value o the rights o the capital increase coƒpleted in „ctoer 216. Value of portfolio at December 31, 2017 and average annual growth, before taxes. (c) …roposed or the 217 fiscal ear at the nnual ‡eneral ˆeeting on ˆa 16 218. AVERAGE Note: the referential ubscription ights relating to the capital increase undertaen in eptember 201 are recognied as having been sold, then reinvested in shares. 3,577 ANNUAL GROWTH (a) 28 OVER 30 YEARS 29 1987 1997 2007 2017 Growth as at 12/31/2017 (b) ADJUSTED NET EARNINGS PER SHARE 5.16 OVER In euros VALUE VALUE 2.90 €140 OVER 5 YEARS €140 +7.5% 10 YEARS Air Liquide +37.30% 1.17 €120 €0 ‚€ƒ.„1… €120 0.59 AVERAGE Air Liquide +66.10% Share at €76.51 ANNUAL OVER GROWTH €0 Š ƒ.37… (a) €100 €100 OVER 30 YEARS 20 YEARS Share at €63.25 Air Liquide +296.69% 1987 1997 2007 2017 €80 €0 ‚77.1ƒ… €80 Share at €26.48 (b) (c) ADJUSTED DIVIDEND PER SHARE 2.65 €60 €60 In euros 1.39 +8.6% €40 €40 0.22 0.43 AVERAGE Share at € 105.05 ANNUAL €20 2017 performance† €20 GROWTH Air Liquide + 9.38% (a) €0 ‚ „.2… OVER 30 YEARS €0 €0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 1987 1997 2007 2017 (a) Calculated according to prevailing accounting rules over 3 ears. hare price ad‹usted to tae into account the stoc split in 2007, the free share attributions, and the capital increase ir ˆi‰uide () dusted or the 2 or 1 share split in 27 or attriutions o ree shares and or a actor o .€74 reflecting in 201 lined to the ac‰uisition of irgas. hare price as at 12Œ31 of the ‡ear concerned. the value o the rights o the capital increase coƒpleted in „ctoer 216. Note: past performances of ir ˆi‰uide’s share are not a guarantee of future results. €0Šindexed (c) …roposed or the 217 fiscal ear at the nnual ‡eneral ˆeeting on ˆa 16 218.

2018 Shareholder's Guide Page 28 Page 30

2018 Shareholder's Guide Page 28 Page 30