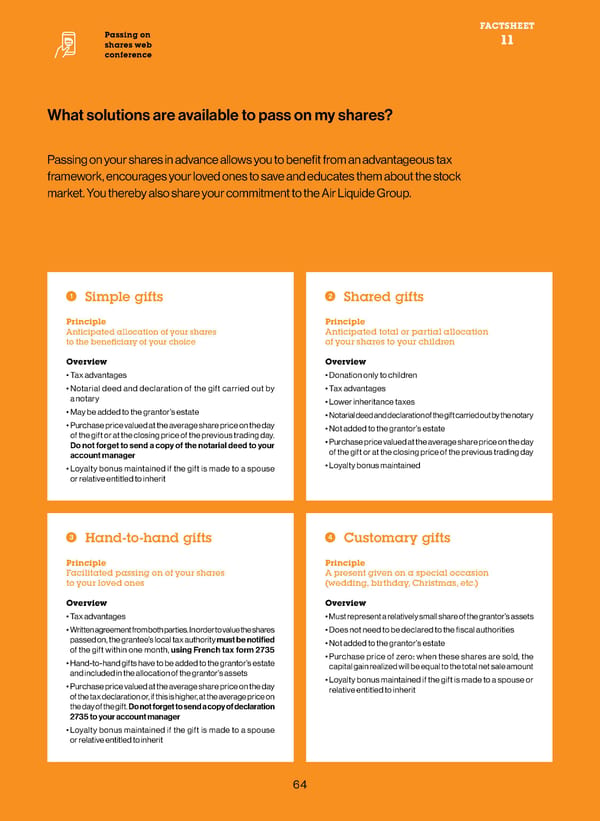

FACTSHEET Passing on 11 shares web conference Passing on shares and taxation Inheritance: the choice is yours! What solutions are available to pass on my shares? You can decide how your assets, including Air Liquide Shareholder Services for direct FIGURES your share portfolio, will be distributed registered shareholders, or your financial The elements of taxation in this factsheet apply to French residents for tax purposes. among your heirs. Upon your death, a institution for intermediary registered TAX EXEMPTION declaration signed by your notary stating shareholders and bearer shareholders, FOR DONATIONS Passing on your shares in advance allows you to benefit from an advantageous tax your marital status, the names of all benefi- will execute all instructions given by your framework, encourages your loved ones to save and educates them about the stock ciaries and the number of shares attributed notary or the person managing your estate. Every 15 years you are able to make to each beneficiary is sufficient to distribute a tax exempt donation for up to: market. You thereby also share your commitment to the Air Liquide Group. a portfolio. €100,000 for each child and from each parent Seek advice €80,724 f or a spouse or civil partner 4 ways of passing on shares Your notary can advise you on personalized solutions for passing on marketable shares €31,865 f or each grandchild as part of a gift or inheritance and will write the deeds. €15,932 for each brother Some examples: and sister 1 Simple gifts 2 Shared gifts Inter-vivos distribution donations allow you to pass on your shares while continuing to €7,967 f or each nephew receive the dividends, i.e. retain the usufruct. The usufruct can be full or partial. Donation or niece Principle Principle rights are reduced as they are based on the bare ownership value of the donation. On the €5,310 for each great- Anticipated allocation of your shares Anticipated total or partial allocation death of the grantor, the bare owners recover the usufruct and therefore full ownership of grandchild to the beneficiary of your choice of your shares to your children the shares. Dividends from free shares attributed after the donation are also paid to the beneficial owner. Overview Overview • Tax advantages • Donation only to children The ban on giving up your shares prevents the sale of the shares or their donation • Notarial deed and declaration of the gift carried out by • Tax advantages for a set period. a notary • Lower inheritance taxes The right of return allows the grantor to take possession of the shares again if the • May be added to the grantor’s estate • Notarial deed and declaration of the gift carried out by the notary grantee dies first. • Purchase price valued at the average share price on the day • Not added to the grantor’s estate of the gift or at the closing price of the previous trading day. • Purchase price valued at the average share price on the day Do not forget to send a copy of the notarial deed to your Contactez-nous Rencontrez-nous Écrivez-nous Espace actionnaires Service actionnaires of the gift or at the closing price of the previous trading day 0 800 166 179 Ouvert du lundi au vendredi 75, quai d’Orsay de 9 heures à 18 heures 751 Paris ede 07 ou + 33 (0)1 57 05 02 26 75, quai d’Orsay ou directeent sur le site account manager depuis l’international 75007 Paris http contactactionnairesairliquideco • Loyalty bonus maintained if the gift is made to a spouse • Loyalty bonus maintained PLUS or relative entitled to inherit A LASTING GIFT Parents, grandparents, give shares to your children and grandchildren! Shareholder Services sends a gift 3 Hand-to-hand gifts 4 Customary gifts envelope directly to your loved ones as part of your gift of shares when you Principle Principle make a donation. Facilitated passing on of your shares A present given on a special occasion to your loved ones (wedding, birthday, Christmas, etc.) Overview Overview • Tax advantages • Must represent a relatively small share of the grantor’s assets • Written agreement from both parties. In order to value the shares • Does not need to be declared to the fiscal authorities GOOD TO KNOW passed on, the grantee’s local tax authority must be notified • Not added to the grantor’s estate of the gift within one month, using French tax form 2735 • Purchase price of zero: when these shares are sold, the LOYALTY BONUS • Hand-to-hand gifts have to be added to the grantor’s estate capital gain realized will be equal to the total net sale amount In the case of passing on shares or gifts to a spouse or a relative entitled to inherit, any loyalty and included in the allocation of the grantor’s assets • Loyalty bonus maintained if the gift is made to a spouse or • Purchase price valued at the average share price on the day relative entitled to inherit bonus attached to Air Liquide shares is retained. of the tax declaration or, if this is higher, at the average price on DIRECT REGISTERED SHAREHOLDERS the day of the gift. Do not forget to send a copy of declaration 2735 to your account manager You can download “Hand-to-hand gifts” and “Customary gifts” forms on the airliquide.com website, • Loyalty bonus maintained if the gift is made to a spouse in Shareholders / Media Library / Forms. For gifts completed before a notary, do not forget to send or relative entitled to inherit the notarized documents to Air Liquide’s Shareholder Services. 64 65

2018 Shareholder's Guide Page 64 Page 66

2018 Shareholder's Guide Page 64 Page 66